Version: 1.0

Date adopted: 16 June 2021

This privacy notice provides a high-level overview of how we use and share personal information across TransUnion. You can find more detailed information at the TransUnion Privacy Center or in other privacy information you may have received.

In this Privacy Notice, any reference to TransUnion includes any of the entities listed below:

- TransUnion Africa Holdings (Pty) Ltd, 2012/035271/07

- TransUnion Africa (Pty) Ltd, 1992/007124/07

- TransUnion Analytic and Decision Services (Pty) Ltd, 1992/000475/07

- TransUnion Auto Information Solutions (Pty) Ltd, 2000/018558/07

- TransUnion Credit Bureau (Pty) Ltd, 2004/007773/07

In Brief

TransUnion strives to protect privacy as we collect, use, process, disclose, transfer and retain personal information.

You have the right to decide who uses your personal information and how.

If your personal information is used unlawfully or infringes on your privacy, you have the right to object.

This notice covers the following topics:

- Who we are and how to contact us

- How we use personal information

- Where we get personal information

- How long we keep personal information

- Our legal basis for handling personal information

- Who we share personal information with

- Where we store and send personal information

- Your rights concerning your personal information

- Where to lodge a complaint

1.  Who we are and how to contact us

Who we are and how to contact us

Information for Good®

We're in an era of rapid digital transformation where consumers demand more access to seamless, personalised products and services online. But the currency of personal data that fuels this platform economic boom poses threats to individuals and endangers corporate security.

Now more than ever — and likely more so in the future — consumers and corporates need new levels of trust and transparency.

As a global information and insights company, TransUnion seeks to make trust possible. We do this by curating an accurate and comprehensive picture of each consumer so they're safely and reliably represented in the marketplace. This enables businesses and consumers to transact with confidence and achieve great things. We call this Information for Good.

We're a group of companies with registered offices at TransUnion, 10th Floor, 11 Alice Lane, Sandton, Johannesburg 2196. Although we're part of a larger group, this notice covers only the activities of TransUnion companies within the Republic of South Africa.

Jointly responsible parties

TransUnion companies sometimes cooperate with other TransUnion companies when sharing and making decisions about your personal information. When this happens, all employees across the group ensure each company involved complies with data protection rules.

Contact our Consumer Services Team to enquire about any of our companies or exercise your rights regarding your personal information.

Contact details

Contact us about personal information issues, including the contents of this notice via:

- Post: TransUnion PO Box 4522 Johannesburg 2000

- Telephone: TransUnion Contact Centre: 0861 482 482

2.  How we use personal information

How we use personal information

TransUnion limits the use and disclosure of personal information to the terms of the National Credit Act 34 of 2005 (NCA), Protection of Personal Information Act 4 of 2013 (PoPIA) or any other applicable laws.

Unless we have your consent or the law permits us, we will not sell, rent or lease your personal information to others. We will not use or share your personal information in ways unrelated to the circumstances described below.

Unless permitted by the laws or with your consent, we do not use any personal information concerning religious or philosophical beliefs, race or ethnic origin, trade union membership, political persuasion, health, sex life or biometric data.

Products and services

Many of our products and services rely on personal information. For example:

Credit reporting: TransUnion compiles consumer credit information in credit reports from applications to (for example) credit providers or services providers for credit or services.

Direct marketing: When you visit a TransUnion Site, we may invite you to sign up for information, promotional offers and marketing.

You can sign up for our news during the online ordering process by ticking the opt-in box, "I want to receive news and information on products to help me manage my debt better."

If you consent, TransUnion will access, use, process and analyse your personal information, your consumer credit information, Internet activity and marketing data to provide personalised offers from TransUnion and our trusted partners.

Digital marketing: To provide relevant products and services to consumers, we enable business partners to use our data and technology to create, deploy and measure targeted digital advertising programs.

Advertising: We may use domestic or overseas third-party advertising companies to serve ads on TransUnion Site or on other sites which we use for advertising. We may also use third-party analytical tools to personalise advertisements and enhance the visitor experience.

Market research: Participation in market research activities is optional. When you opt-in, we use your information to improve the experience of our products and services. Third parties assisting with market research can keep non-personal aggregated data for our research purposes.

Business products: We may use personal information to promote and market relevant products, services and special offers from us and our affiliates.

Customer service: We may use personal information to identify customers, process transactions and provide quality service.

Recruitment: We use personal information when we receive an employment application.

Business operations

We may use personal information for our internal operations, such as:

Names, contact details and other information from consumers who contact us to deal with their enquiries. See our Customer Service Privacy Notice for more.

Employee information (including employment and educational history, background checks and performance appraisals) to manage our relationship.

CCTV cameras in public areas of our business premises for the safety of staff and visitors, and the security of our information and assets.

Legal and regulatory purposes, such as responding to complaints or enquiries about how we have used personal information.

In addition, we may aggregate anonymised data to provide advertising performance analytics to business partners.

For more details on the kinds of data used for each purpose described, visit the TransUnion Privacy Center

For more on our use of cookies, see our Cookie Policy.

3.  Where we get personal information

Where we get personal information

We get personal information directly from our business partners, suppliers, clients, site visitors, and product and services customers signing up for any of our products or services.

When visitors use any products or functions in a TransUnion Site, we collect general internet data (including internet protocol ("IP") address, metadata, location data, date and time of the visit) and behavioural data, such as searches transactions and purchases.

We also receive anonymous information from websites where we display advertisements to enhance or modify our campaigns.

We collect user information anonymously without linking data to personal information other than authenticating and protecting private data.

4.  How long we keep personal information

How long we keep personal information

Simply put, we keep personal information for as long as necessary. More technically, we retain it to fulfil the purpose(s) of its provision, to comply with applicable laws, and for as long as your consent to such purpose(s) remains valid after termination of our relationship.

5.  Our legal basis for handling personal information

Our legal basis for handling personal information

Legitimate interests

The Protection of Personal Information Act (POPIA) allows personal information usage where necessary for legitimate purposes without undue adverse impact. We base most of our processing activities on the 'legitimate interests' condition. For more details, refer to the relevant privacy notices in the links above.

Consent

We sometimes rely on consent to process personal information, but this is relatively rare. Refer to the relevant privacy notices at www.transunion.co.za/privacy for more details.

Contracts

If you sign up for one of our online services, we need to use personal information to provide the services as set out in the Terms & Conditions. We also use this basis for processing some of our staff data. Refer to the privacy notice on the relevant website for details.

Compliance

We only access, use and disclose personal information without consent in exceptional circumstances where necessary to:

- Comply with the law or a legal process served on us

- Comply with requests for information from police or government authorities

- Protect and defend our rights or property (including the enforcement of agreements)

- Protect the public interest

- Act in urgent circumstances to protect the personal safety of our employees or members of the public

- Act on implied consent

We apply the above in terms of the NCA, PoPIA and other relevant national legislation.

6.  Who we share personal information with

Who we share personal information with

Our group of companies

As stated, we share personal information among TransUnion RSA companies where appropriate. We have set out a list of current such companies below.

Group Company | Physical Address |

TransUnion Africa Holdings (Pty) Ltd | TransUnion |

TransUnion Credit Bureau (Pty) Ltd | |

TransUnion Africa (Pty) Ltd | |

TransUnion Analytic and Decision Services (Pty) Ltd | |

TransUnion Auto Information Solutions (Pty) Ltd |

Clients and resale partners

Our clients have privacy notices that provide more information about how they use the data we supply. These clients typically operate in the following sectors:

- Auto dealers

- Commercial

- Insurance

- Retail

- Telecommunications

- Collections

- Financial services

- Public sector

- Startup

If our clients appoint an intermediary to act on their behalf, they too will receive the data. We also appoint data resale partners who distribute our data to third parties.

Service providers

Our clients and we might provide information to third parties that help us achieve the purposes described in section 2. For example:

- Cloud-based services, such as Salesforce, help host, manage and analyse our databases.

- Cloud-based technologies, such as Microsoft Office 365, support our ordinary business operations.

- Printing companies to produce and send direct mail or other correspondence.

- Payment service providers to help with payments made by individuals.

- Market research companies to help us better understand our customers.

- A specialist sub-contractor operates our CCTV system.

- Regulators like the Information Commissioner's Office or the Financial Conduct Authority.

These service providers can't use your information for their purposes or on behalf of other organisations unless you agree otherwise.

7.  Where we store and send personal information

Where we store and send personal information

We access and use your information from our base in South Africa. We will not transfer personal information to a country lacking laws that provide an adequate level of information protection - unless we have an agreement with the recipient requiring measures that offer a similar level of protection as POPIA in South Africa.

8.  Your rights concerning personal information

Your rights concerning personal information

We outline your rights regarding the personal information we hold about you below.

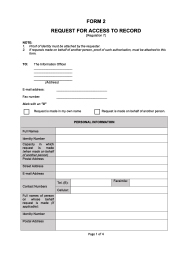

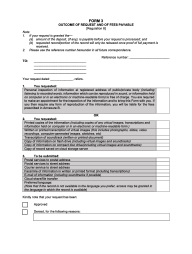

Access: Refer to the PAIA Manual on how to access what personal information we hold about you.

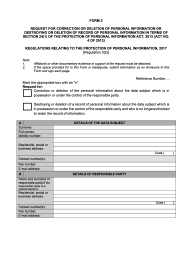

Correction/Destruction/Deletion: If the information we hold about you is inaccurate, irrelevant, excessive, out of date, incomplete, misleading or obtained lawfully, you have a right to ask us to correct it or delete it.

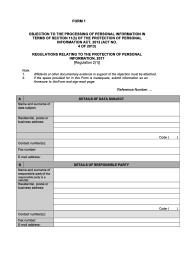

Objection to processing: You may object (on reasonable grounds) to processing your personal information unless legislation provides for such processing.

Objection to direct marketing: You may object to us using your personal information for direct marketing, and if you do, we will stop.

To find out about exercising these rights, please contact us on TransUnion Contact Centre: 0861 482 482.

9.  Where to lodge a complaint

Where to lodge a complaint

We strive to deliver the highest levels of customer service. However, if you’re ever unhappy with us, please contact us so we can investigate.

- Post: PO Box 4522, Johannesburg, 2000

- Telephone: 0861 482 482

You can also contact our Information Officer or Deputy Information Officer at TUAPrivacy@transunion.com

You may complain to the Information Regulator:

- Email: complaints.IR@justice.gov.za

- Post: P.O. Box 31533, Braamfontein, Johannesburg, 2017

- Site: https://www.justice.gov.za/inforeg/

Version: 2.0

Date adopted: 18 June 2021

This privacy notice explains how we use and share personal information in our Credit Reporting Business.

TransUnion Credit Bureau (Pty) Limited ("TransUnion") is a registered credit bureau. We strive to ensure your privacy is protected. This Privacy Policy outlines how we collect, use, process, disclose, transfer and retain your personal information.

We comply with the National Credit Act, 2005 (No.34 of 2005) ("NCA"), the Protection of Personal Information Act, 2013 (No. 4 of 2013) ("PoPIA"), and the principles outlined in Sections 50 and 51 of the Electronic Communications and Transactions Act, 2002 (No.25 of 2002) governing your right to keep your personal information private.

We may process your personal information as part of our function to assist you in obtaining credit responsibly and protecting you against reckless lending.

In this Privacy Policy, "Consumer Credit Information" means consumer credit information defined in Section 70 of the NCA.

In Brief

We provide data and data-related services to clients, such as banks, credit providers, insurance companies and others for the purposes set out above (and in more detail at section 2 below).

This notice covers the following topics:

- Who we are and how to contact us

- How we use personal information

- The kinds of personal information we use and where we get it

- How long we keep personal information

- Our legal basis for handling personal information

- Who we share personal information with

- Where we store and send personal information

- How the personal information is used

- Your rights concerning your personal information

- Where to lodge a complaint

1. Who we are and how to contact us

Information for Good®

We're in an era of rapid digital transformation where consumers demand more access to seamless, personalised products and services online. But the currency of personal data that fuels this platform economic boom poses threats to individuals and endangers corporate security.

Now more than ever — and likely more so in the future — consumers and corporates need new levels of trust and transparency.

As a global information and insights company, TransUnion seeks to make trust possible. We do this by curating an accurate and comprehensive picture of each consumer so they're safely and reliably represented in the marketplace. This enables businesses and consumers to transact with confidence and achieve great things. We call this Information for Good.

We're a group of companies with registered offices at TransUnion, 10th Floor, 11 Alice Lane, Sandton, Johannesburg 2196. Although we're part of a larger group, this notice covers only the activities of TransUnion companies within the Republic of South Africa.

Jointly responsible parties

TransUnion companies sometimes cooperate with other TransUnion companies when sharing and making decisions about your personal information. When this happens, all employees across the group ensure each company involved complies with data protection rules.

Contact our Consumer Services Team to enquire about any of our companies or exercise your rights regarding your personal information.

Contact details

For personal information issues, including the contents of this notice, contact us via:

- Post:TransUnion PO Box 4522 Johannesburg 2000

- Telephone:TransUnion Contact Centre: 0861 482 482

Please refer to our Consumer Contact Privacy Notice for information on how we handle your personal information with complaints and enquiries.

2. How we use personal information

TransUnion limits the use and disclosure of personal information to the terms of the National Credit Act 34 of 2005 (NCA), Protection of Personal Information Act 4 of 2013 (PoPIA) or any other applicable laws.

Credit reporting

We compile consumer credit information in credit reports from applications to (for example) credit providers or services providers for credit or services.

Credit services

We may provide your information to organisations you deal with directly, such as credit risk assessors.

Example: credit risk assessment

If you apply for credit from one of our clients, they send us your data so we can find you in our databases and reply with information about your credit history. They use that information to assess your creditworthiness.

Fraud detection services

We may provide personal information to organisations other than those you deal with directly.

Example: fraud alerts

If we receive numerous identity verification checks against an individual in a short space of time, this could indicate someone is attempting identity theft or another form of fraud. In this case, we provide real-time fraud alerts to clients subscribed to that service.

If you have provided your details to an organisation to confirm your identity, we may retain those details and link them to other details we hold about you. Then, if a fraudster tries to use your details to apply for credit with a different organisation, we can raise a potential fraud alert.

Development and testing

We sometimes use personal information to improve, develop, monitor, maintain and test our products, systems and security measures. Where possible, we create pseudonyms or make the data anonymous beforehand.

Legal and regulatory

We may use your personal information when responding to complaints or enquiries from you or a regulator about how we’ve used your personal information.

3. The kinds of personal information we use and where we get it

Information in your credit report includes:

- Identifying information, such as first name, surname, ID number, physical and postal address, contact numbers, marital status, spouse details, and current employer and occupation

- An account history or payment profile is a 24-month record of all your accounts with credit or service providers and a history of how you pay these accounts

- Enquiries include a list of credit or service providers allowed by you or permitted in terms of the NCA to receive your credit report

- Public records include publicly available information as permitted by law, such as judgments, administration orders, sequestrations and rehabilitation

- Default data is a record of any failure to pay money owed

- Other includes any information permitted under the NCA

Information not included in your credit report:

- Race, creed, colour, ancestry, ethnicity, religion, sexual orientation or political affiliations

- Medical history or status

- Major purchases paid in full with cash or cheques

Sources for information

We may collect your personal information, or obtain information originating from the following sources:

- An organ of state, a court or judicial officer

- Any person who supplies goods, services or utilities to consumers

- A person providing long-term and short-term insurance

- Entities involved in fraud investigation

- Educational institutions

- Debt collectors to whom a credit provider ceded or sold book debt

- Other registered credit bureaus

The information we need

To verify information, credit providers need to include:

- Your initials or full name and surname

- Your South African identity number (if you have on) or your passport number and date of birth Without this information, they can't lawfully grant credit.

Any further information requested by credit providers must be necessary and relevant to your application. No law forces you to give information, but a credit provider can't consider your credit application if you don't provide the information required.

4. How long we keep personal information

Simply put, we keep personal information for as long as necessary. More technically, we retain it to fulfil the purpose(s) of its provision, to comply with applicable laws, and for as long as your consent to such purpose(s) remains valid after termination of our relationship.

The Regulations to the NCA require we use various categories of information only for the maximum periods prescribed for credit scoring or credit assessment.

We keep specific data indefinitely to verify the integrity of the information we may need to process in the future. We store this information securely and don't use it for any other purpose.

5. Our legal basis for handling personal information

Legitimate interests

The Protection of Personal Information Act (POPIA) allows personal information usage where necessary for legitimate purposes without undue adverse impact. We base most of our processing activities on the legitimate interests condition. For more details, refer to the relevant privacy notices in the links above.

Interest | Explanation |

Promoting responsible lending and helping prevent over-indebtedness. | Helping lenders only sell products that are affordable and suitable to the borrowers' circumstances. |

Verifying identity, detecting and preventing crime and fraud | Assisting clients to meet business imperatives, and legal, compliance and regulatory requirements and obligations |

Credit bureau functioning | Supporting the NCA by promoting transparency and fairness in the access to credit, responsible borrowing, and protecting consumers against reckless credit granting. |

Consent

In most instances, consumer consent to use personal information comes to TransUnion via our clients and data suppliers.

You need to agree on who can use your personal information and how. To do this, persons who have your information must notify you they have your data and how they plan to use it.

We strive to ensure our clients and data suppliers honour their contractual obligation to get all legally required consents before accessing personal information in our credit reports.

Contractual agreement

If you sign up for services as set out in our Terms & Conditions, we need to use some of your personal information to fulfil your request. Please refer to the privacy notice on the relevant website for more details.

6. Who we share personal information with

Our clients and resale partners

We share personal information with our clients for the purposes described in Section 2 above. Our clients have privacy notices providing details on how they use the data we supply.

Our clients operate in the following sectors:

- Financial services (including banks, loans, credit cards, mortgages, pensions, and investments and savings providers)

- Insurance

- Retail (including car sales/leasing and online retailers)

- Telecommunications

- Marketing agencies acting for other organisations

- Auto dealers

- Commercial

- Collections

Our group of companies

As stated, we share personal information among TransUnion RSA companies where appropriate. We have set out a list of current such companies below.

Group Company | Physical Address |

TransUnion Africa Holdings (Pty) Ltd | TransUnion |

TransUnion Credit Bureau (Pty) Ltd | |

TransUnion Africa (Pty) Ltd | |

TransUnion Analytic and Decision Services (Pty) Ltd | |

TransUnion Auto Information Solutions (Pty) Ltd |

Service providers

Our clients and we may provide information to third parties helping us achieve the purposes described in Section 2. For example:

- Third parties may host our databases on our behalf.

- Printing companies produce and send direct mail or other correspondence.

- Payment service providers process payments made by individuals.

- Market research companies help us better understand our customers.

- Cloud-based technologies, such as Microsoft Office 365 and Salesforce, help our business operations.

- A specialist sub-contractor operates our CCTV system.

These service providers can't use your information for their purposes or on behalf of other organisations unless you agree otherwise.

7. Where we store and send personal information

We access and use your information from our base in South Africa. We will not transfer personal information to a country lacking laws that provide an adequate level of information protection — unless we have an agreement with the recipient requiring measures that offer a similar level of protection as POPIA in South Africa.

8. How the personal information is used

We don't use your personal information to make automated decisions about you or to profile you.

We provide data and analytics that help our clients make decisions about lending and other matters, but their data, knowledge, processes and practices play a significant role in those decisions.

For example, when we sell our services to credit or loan providers, we do not decide whether they should grant you credit or a loan — this is for the lender to decide.

9. Your rights concerning personal information

Your personal information belongs to you, and you can determine who uses it and how. We briefly describe your rights below.

Access: You can find out if and what personal information we hold about you. Refer to the PAIA Manual on how to request access.

Correction/Destruction/Deletion: If the information we hold is inaccurate, irrelevant, excessive, out of date, incomplete, misleading or obtained lawfully, you have a right to ask us to correct or delete it.

Objection to processing: You may object (on reasonable grounds) to processing your personal information unless legislation provides for such processing.

Objection to direct marketing: You may object to us using your personal information for direct marketing, and if you do, we will stop.

There are several ways you can object If someone uses your personal information unlawfully or in a manner that infringes your privacy. To find out more, please contact the TransUnion Contact Centre: 0861 482 482.

10. Where to lodge a complaint

We strive to deliver the highest levels of customer service. However, if you're ever unhappy with us, please contact us so we can investigate.

- Post: PO Box 4522, Johannesburg, 2000

- Telephone: 0861 482 482

You can also contact our Information Officer or Deputy Information Officer at TUAPrivacy@transunion.com

Please refer to our Consumer Contact Privacy Notice for information about how we handle your personal information in connection with complaints and enquiries.

You can also contact the Information Regulator:

- Email: complaints.IR@justice.gov.za

- Post: O. Box 31533, Braamfontein, Johannesburg, 2017

- Site: https://www.justice.gov.za/inforeg

Version: 2.0

Date adopted: 16 June 2021

This privacy notice provides information about how we use and share the personal information of people using our business products and technical support facilities.

| In Brief |

| We use personal information to administer your access to and monitor your use of our products. |

| We may provide information about your use of our products to the organisation you work for. |

This notice covers the following topics:

- Who we are and how to contact us

- What we use personal information for

- The kinds of personal information we use and where we get it

- How long we keep personal information

- Our legal basis for handling personal information

- Who we share personal information with

- Where we store and send personal information

- Your rights concerning your personal information

- Where to lodge a complaint

1. Who we are and how to contact us

Information for Good®

We’re in an era of rapid digital transformation where consumers demand more access to seamless, personalised products and services online. But the currency of personal data that fuels this platform economic boom poses threats to individuals and endangers corporate security.

Now more than ever — and likely more so in the future — consumers and corporates need new levels of trust and transparency.

As a global information and insights company, TransUnion seeks to make trust possible. We do this by curating an accurate and comprehensive picture of each consumer so they’re safely and reliably represented in the marketplace. This enables businesses and consumers to transact with confidence and achieve great things. We call this Information for Good.

We’re a group of companies with registered offices at TransUnion, 10th Floor, 11 Alice Lane, Sandton, Johannesburg 2196. Although we’re part of a larger group, this notice covers only the activities of TransUnion companies within the Republic of South Africa.

Joint responsible parties

TransUnion companies sometimes cooperate with other TransUnion companies when sharing and making decisions about your personal information. When this happens, all employees across the group ensure each company involved complies with data protection rules.

Contact our Consumer Services Team to enquire about any of our companies or exercise your rights regarding your personal information.

Contact details

Contact us about personal information issues, including the contents of this notice via:

- Post:TransUnion PO Box 4522 Johannesburg 2000

- Telephone:TransUnion Contact Centre: 0861 482 482

2. What we use personal information for

Operating our products and administering accounts

We use personal information to operate our products and administer the accounts of people who use them.

Example

We hold username and password details to control access to products.

Security and breach reporting

We monitor access to our products to ensure only authorised people access our products and data. If we detect suspicious activity, we may suspend an account and investigate.

Feedback to clients

Sometimes we share data with clients (or their affiliates, business partners or group companies) about how their employees use our products. For example, how often and why a staff member uses a product. Clients may ask for this information in deciding whether to continue buying the product or staff management in checking whether products are being used properly.

If the information shows employee misconduct, an employer might use that information as part of a disciplinary process.

Example

A bank suspects an employee is performing unauthorised credit report searches and asks us for details of the searches conducted by that person. The bank uses this information to support its internal investigation into that employee’s actions.

Monitoring and improving our products

Information, such as how different people use our products, how long they spend on particular tasks and what sort of information they look for, helps us customise and improve our products. We also use this information for security and system administration and to generate non-personalised information for client use.

Product or systems development and testing

We may use personal information while developing or testing our products, systems and security measures. Where possible, we create pseudonyms or otherwise anonymise such data.

Providing technical support and responding to queries

If you contact us with a question about one of our product or services, we use your personal information to provide the answer. This includes contacting you about your request and sometimes about queries raised by other users.

Queries: legal and regulatory purposes

We may also need to use your personal information for legal and regulatory purposes.

Example: legal and regulatory purposes

If you make a complaint about us to our regulators, they’ll normally ask us to investigate your case. This will involve accessing your personal information. Similarly, if you start court proceedings against us, we’ll normally need to review how we have used your personal information to defend ourselves against your claim.

3. The kinds of personal information we use and where we get it

We obtain and use information from various sources summarised in the following table.

Type of information | Description | Source |

Basic information about you and how to contact you | Name, email address and job title | You or your employer when we set up your account or are told the information has changed |

Login credentials | Username, password and other information controlling product access | |

Product usage | How and when you access and use the product, including dates and times, IP address, and how you use the product while logged in | Monitoring your product usage |

Your requests and enquiries | Information you provide as part of a technical support query, request or enquiry | Directly from you |

We need your personal information to provide our products correctly. You don’t have to provide us with personal information for technical support requests, but this may impede the help we can provide.

4. How long we keep personal information

Simply put, we keep personal information for as long as necessary. More technically, we retain it to fulfil the purpose(s) of its provision, comply with applicable laws, and for as long as your consent to such purpose(s) remains valid after termination of our relationship.

5. Our legal basis for handling personal information

Legitimate interests

The Protection of Personal Information Act (POPIA) allows personal information usage where necessary for legitimate purposes without undue adverse impact. We base most of our processing activities on the legitimate interests listed below.

Interest | Explanation |

Market our products and services | To allow our business to reach the maximum number of clients |

Develop and improve our products and services | To help us remain competitive, differentiated and attractive to clients |

Monitor and secure our systems and data | To fulfil our promise by keeping our systems and our data safe and secure |

Maintain our client relationships | To build trust with our clients and business partners by outperforming and over-delivering |

Entrench our commercial interests | To earn sustainable revenue through the efficient and effective provision of competitive products and services |

6. Who we share personal information with

Our group companies

As stated, we share personal information among TransUnion companies as appropriate. We’ve set out a list of current such companies below.

Group Company | Physical Address |

TransUnion Africa Holdings (Pty) Ltd | TransUnion |

TransUnion Credit Bureau (Pty) Ltd | |

TransUnion Africa (Pty) Ltd | |

TransUnion Analytic and Decision Services (Pty) Ltd | |

TransUnion Auto Information Solutions (Pty) Ltd |

Clients

As mentioned in Section 2, if asked, we may supply usage information about a TransUnion product to an employer, its affiliates, business partners or group companies.

Service providers

We may provide information to third parties who help us use it for purposes described in Section 2.

Third-party usage

We may use a third-party email broadcasting service to send you service emails. However, unless you agree otherwise, these service providers can’t use your information for their purposes or on behalf of other organisations.

Sometimes we may need to supply information to third parties (such as our service providers or other companies in the TransUnion group) to help deal with a support request or further enquiry.

Regulators and law enforcement

We share personal information with government authorities and law enforcement officials if required by law or for legal protection of our legitimate interests in compliance with applicable laws.

7. Where we store and send personal information

We access and use your information from our base in South Africa. However, we will not transfer personal information to a country lacking laws that provide an adequate level of information protection — unless we have an agreement with the recipient requiring measures that offer a similar level of protection as POPIA in South Africa.

8. Your rights concerning your personal information

Access: You have the right to find out if and what personal information we hold about you. Refer to the PAIA Manual on how to request access.

Correction/Destruction/Deletion: If the information we hold about you is inaccurate, irrelevant, excessive, out of date, incomplete, misleading or obtained lawfully, you have a right to ask us to correct it or delete it.

Objection to processing: You may object (on reasonable grounds) to processing your personal information unless legislation provides for such processing.

Objection to direct marketing: You may object to us using your personal information for direct marketing, and if you do, we will stop.

9. Where to lodge a complaint

We try to deliver the highest levels of customer service. However, if you’re ever unhappy with us, please contact us so we can investigate.

- Post: PO Box 4522, Johannesburg, 2000

- Telephone: 0861 482 482

You can also contact our Information Officer or Deputy Information Officer at TUAPrivacy@transunion.com

You may complain to the Information Regulator:

- Email: complaints.IR@justice.gov.za

- Post: O Box 31533, Braamfontein, Johannesburg, 2017

- Site: https://www.justice.gov.za/inforeg

Version: 2.0

Date adopted: 18 June 2021

This privacy notice provides information about how we use and share consumers' personal information for our clients' marketing purposes.

This notice covers the following topics:

- Who we are and how to contact us

- How we use personal information

- Where we get personal information

- How long we keep personal information

- Our legal basis for handling personal information

- Who we share personal information with

- Where we store and send personal information

- Your rights concerning your personal information

- Where to lodge a complaint

1. Who we are and how to contact us

Information for Good®

We're in an era of rapid digital transformation where consumers demand more access to seamless, personalised products and services online. But the currency of personal data that fuels this platform economic boom poses threats to individuals and endangers corporate security.

Now more than ever — and likely more so in the future — consumers and corporates need new levels of trust and transparency.

As a global information and insights company, TransUnion seeks to make trust possible. We do this by curating an accurate and comprehensive picture of each consumer so they're safely and reliably represented in the marketplace. This enables businesses and consumers to transact with confidence and achieve great things. We call this Information for Good.

We're a group of companies with registered offices at TransUnion, 10th Floor, 11 Alice Lane, Sandton, Johannesburg 2196. Although we're part of a larger group, this notice covers only the activities of TransUnion companies within the Republic of South Africa.

Jointly responsible parties

TransUnion companies sometimes cooperate with other TransUnion companies when sharing and making decisions about your personal information. When this happens, all employees across the group ensure each company involved complies with data protection rules.

Contact our Consumer Services Team to enquire about any of our companies or exercise your rights regarding your personal information.

Contact details

Contact us about personal information issues, including the contents of this notice via:

- Post:TransUnion PO Box 4522 Johannesburg 2000

- Telephone:TransUnion Contact Centre: 0861 482 482

2. How we use personal information

You can find more detail about the personal information we might use for these purposes in Section 3 below.

Direct marketing

If you give your consent or law permits it, we may use your personal information for direct marketing purposes. We may access, use, process and analyse personal information provided by you, your consumer credit information, Internet information and marketing data to provide personalised offers from TransUnion and our trusted partners.

Opting out

Suppose you no longer want to receive such communications. In that case, you can opt-out by responding to the newsletter and asking to be unsubscribed, or calling our customer service department and asking to be taken off the list. Alternatively, you can go to transunion.co.za, log in as a subscriber, click on your "profile" link, go to "My Settings", and de-select the Emails and Special offers opt-in box.

Digital marketing

Our digital marketing services enable our business partners to communicate with consumers about relevant products and services. These businesses use our data and technology to devise, create, deploy and measure targeted advertising programs. We also aggregate and depersonalise data for analytical purposes to provide statistical reporting and performance measurements.

Market research

If you choose to take part in market research, we may use your information to improve our products and services. If we engage third parties to assist, they can use non-personal aggregated data, but they use all personal information for our research purposes only.

Consumer engagement

With your consent, we may use your personal information to present additional products, services, and special offers from our affiliates and marketing partners. We may also share basic information — name and email address — with third parties to fulfil your request.

Our third-party email processor may use action tags (also known as single-pixel gif or web beacons) to collect anonymous information on your use of the TransUnion Site in connection with the email registration program.

If you do not register your ID Number, we will not collect any personal information while you visit TransUnion Site.

Client data enhancement

Some TransUnion clients provide data collected under their separate privacy notices and ask us to enhance it. Here, our client is responsible for ensuring the personal information is used fairly and lawfully. You can refer to their privacy notices for details on the data they collect, what they use it for, and how to exercise your rights.

Development and testing

We sometimes use personal information while improving, developing, monitoring, maintaining and testing our products, systems and security measures. Where possible, we create pseudonyms, anonymity or aggregate the data beforehand.

Consumer queries

We will sometimes use your personal information to help deal with your enquiry and for legal and regulatory purposes.

Legal compliance with laws and regulations

We only access, use and disclose personal information without consent in exceptional circumstances where necessary to:

- Comply with the law or a legal process served on us

- Comply with requests for information from police or government authorities

- Protect and defend our rights or property (including the enforcement of agreements)

- Protect the public interest

- Act in urgent circumstances to protect the personal safety of our employees or members of the public

- Act on implied consent

We apply the above in terms of the NCA, PoPIA and other relevant national legislation.

3. Where we get personal information

We get personal information directly from our business partners, suppliers, clients, site visitors, and customers signing up for any of our products or services.

There are various types and categories of personal information we gather for marketing, including:

Marketing — consumer, household, business, non-personal aggregated information, and advertising program performance data.

Demographic — age, gender, income, occupation, education and marital status.

Life events — a recent move or home purchase.

Public records — census data, geographic data, property data from local tax assessor and recorded deed information.

Firmographic — type of business, years in business, size of business, and job titles.

4. How long we keep personal information

We keep personal information for as long as we handle your request and for an additional period after completion — as determined by:

- Demonstrating appropriate processes are in place to deal with enquiries, requests and complaints, and that we’re doing so fairly and under our regulatory requirements

- Responding to requests from you or a regulator to explain how we dealt with a request and to show we dealt with it properly

- Defending potential legal claims or regulatory action resulting from the request

5. Our legal basis for handling personal information

This section explains the basis on which we process your personal marketing information.

Legitimate interests

The Protection of Personal Information Act allows the use of personal information where necessary for legitimate purposes, provided this isn't outweighed by the impact it has on you. We base most of our processing activities on the legitimate interests condition.

The legitimate interests we’re pursuing are:

Interest | Explanation |

Commercial interests | Earning revenue through the products and services we provide to our customers and clients. |

Improving the accuracy of marketing materials | Removing out-of-date contact details and providing up-to-date contact details where possible. |

For more details, refer to the relevant privacy notices in the links above.

6. Who we share personal information with

Our group of companies

As stated, we share personal information among TransUnion companies as appropriate. We've set out a list of current such companies below.

Group Company | Physical Address |

TransUnion Africa Holdings (Pty) Ltd | TransUnion |

TransUnion Credit Bureau (Pty) Ltd | |

TransUnion Africa (Pty) Ltd | |

TransUnion Analytic and Decision Services (Pty) Ltd | |

TransUnion Auto Information Solutions (Pty) Ltd |

Clients and resale partners

Our clients have privacy notices that provide more information about how they use the data we supply. These clients typically operate in the following sectors:

- Auto dealers

- Commercial

- Insurance

- Retail

- Telecommunications

- Collections

- Financial services

- Public sector

- Startup

If our clients appoint an intermediary to act on their behalf, they too will receive the data. We also appoint data resale partners to distribute our data to third parties.

Service providers

Our clients and we may provide your information to third parties who help us achieve the purposes described in section 2. For example:

- Third parties may host our databases of personal information

- Printing companies produce and send direct mail or other correspondence.

- Market research companies help us better understand our customers.

- Cloud-based technologies, such as Microsoft Office 365, support our ordinary business operations.

These service providers can't use your information for their purposes or on behalf of other organisations unless you agree otherwise.

7. Where we store and send personal information

We access and use your information from our base in South Africa. We will not transfer personal information to a country lacking laws that provide an adequate level of information protection — unless we have an agreement with the recipient requiring measures that offer a similar level of protection as POPIA in South Africa.

8. Your rights concerning personal information

We outline your rights regarding the personal information we hold about you below.

Access: Refer to the PAIA Manual on how to access what personal information we hold about you.

Correction/Destruction/Deletion: If the information we hold about you is inaccurate, irrelevant, excessive, out of date, incomplete, misleading or obtained lawfully, you have the right to ask us to correct or delete it.

Objection to processing: You may object (on reasonable grounds) to processing your personal information unless legislation provides for such processing.

Objection to direct marketing: You may object to us using your personal information for direct marketing, and if you do, we will stop.

To find out about exercising these rights, please contact us on TransUnion Contact Centre: 0861 482 482.

9. Where to lodge a complaint

We strive to deliver the highest levels of customer service. However, if you're ever unhappy with us, please contact us so we can investigate.

- Post: PO Box 4522, Johannesburg, 2000

- Telephone: 0861 482 482

You can also contact our Information Officer or Deputy Information Officer at TUAPrivacy@transunion.com

You may complain to the Information Regulator:

- Email: complaints.IR@justice.gov.za

- Post: O Box 31533, Braamfontein, Johannesburg, 2017

- Site: https://www.justice.gov.za/inforeg

Version: 2.1

Date adopted: 17 June 2021

This document provides information about how we use and share personal information relating to our business contacts.

In Brief

We use personal information to:

- Manage our relationship with our business contacts and keep in touch with them

- Promote our products and services to our customers and potential customers

We use tracking, monitoring and profiling techniques as part of our marketing decisions to help us decide who to contact, about what, and when.

This notice covers the following topics:

- Who we are and how to contact us

- How we use personal information

- The kinds of personal information we use and where we get it

- How long we keep personal information

- Our legal basis for handling personal information

- Who we share personal information with

- Where we store and send personal information

- Your rights concerning your personal information

- Where to lodge a complaint

1. Who we are and how to contact us

Information for Good®

We’re in an era of rapid digital transformation where consumers demand more access to seamless, personalised products and services online. But the currency of personal data that fuels this platform economic boom poses threats to individuals and endangers corporate security.

Now more than ever — and likely more so in the future — consumers and corporates need new levels of trust and transparency.

As a global information and insights company, TransUnion seeks to make trust possible. We do this by curating an accurate and comprehensive picture of each consumer so they’re safely and reliably represented in the marketplace. This enables businesses and consumers to transact with confidence and achieve great things. We call this Information for Good.

We’re a group of companies with registered offices at TransUnion, 10th Floor, 11 Alice Lane, Sandton, Johannesburg 2196. Although we’re part of a larger group, this notice covers only the activities of TransUnion companies within the Republic of South Africa.

Joint responsible parties

TransUnion companies sometimes cooperate with other TransUnion companies when sharing and making decisions about your personal information. When this happens, all employees across the group ensure each company involved complies with data protection rules.

Contact our Consumer Services Team to enquire about any of our companies or exercise your rights regarding your personal information.

Contact details

Contact us about personal information issues, including the contents of this notice via:

- Post:TransUnion PO Box 4522 Johannesburg 2000

- Telephone:TransUnion Contact Centre: 0861 482 482

2. How we use personal information

Relationship management

We use personal information to maintain and develop our relationships with clients, suppliers and their representatives.

Example: relationship management

- Informing you about product changes or planned maintenance activity

- Contacting you with billing enquiries

- Inviting you to events and webinars

- Corresponding with you about your enquiries

- Conducting surveys to collect qualitative and quantitative feedback

- Canvassing you about products or product features you want us to develop

Marketing

We use personal information to market our products and services to current and potential clients and their representatives. This includes providing industry insights, commentary and research on data and software, notification of events and webinars, and updates on products and services.

Example: Marketing

- Monitoring your interactions to understand the products and services that interest you so we can tailor our marketing

- Contacting you by email, telephone or post to tell you about products and services we think will interest you

Providing services

Sometimes we use personal information to provide information, services, alerts and other facilities requested. For example, we might use your contact details to grant access to one of our webinars.

As a registered user of one of our products, we may use your personal information within that product — please refer to the privacy notice available within the product or our Business Product & Technical Support Privacy Notice for more details.

Monitoring and improving our websites

We use information such as how different people navigate our websites, how long they spend on particular pages and what content they download. This helps us improve the user experience by tailoring our website to match individual interests and preferences.

Security and systems administration

We also use this information for security and system administration to generate non-personalised data (such as statistics on the uptake of services and patterns of browsing). In addition, we may share this anonymous data with business contacts, selected third parties, sponsors and advertisers.

Legal and regulatory purposes

We may also need to use your personal information for legal and regulatory purposes.

3. The kinds of personal information we use and where we get it

We obtain and use information from various sources summarised in the following table.

Type of information | Description | Source |

Name and contact details | Basic personal information about you and your workplace | Usually provided by the individual via telephone, email, our websites or in person at an event

|

Organisation-related details | Your organisation, department and role | |

Login credentials | Username and password recorded when you sign up to any of our web-based services | Provided by the user or AI-generated or by us (if we reset a password) |

Contact history | Our engagements, such as information exchanged, meetings, events or webinars attended, emails opened, links clicked and contacts within TransUnion | We produce these records |

Device information | The type of device used to access our websites, its operating system, cookies, browser and IP address | We produce this information |

Website usage | Use of our websites, such as pages visited and content downloaded |

We need your personal information to provide our products correctly. You don’t have to provide us with personal information for technical support requests, but this may impede the help we can provide.

4. How long we keep personal information

Simply put, we keep personal information for as long as necessary. More technically, we retain it to fulfil the purpose(s) of its provision, comply with applicable laws, and for as long as your consent to such purpose(s) remains valid after termination of our relationship.

5. Our legal basis for handling personal information

Legitimate interests

The Protection of Personal Information Act (POPIA) allows personal information usage where necessary for legitimate purposes without undue adverse impact. We base most of our processing activities on the legitimate interests listed below.

Interest | Explanation |

Strategic customer engagement

| Develop and leverage our understanding of customers and suppliers and how they use our products and services

|

Strategically targeted marketing | Promote new and existing products and services to suitable current and potential clients |

Develop new and improve existing products and services | Help us remain competitive, differentiated and attractive to clients by providing world-class, future-fit solutions |

Monitor and secure our systems and data | Fulfil our promise by keeping our systems and data secure |

Other legal bases

Sometimes we process personal information on the following grounds:

Grounds | Examples |

Consent | We’ll ask if you agree to us using your data in specified ways, such as when you tick a box showing you wish to receive marketing emails or telephone calls from us |

Contractual

| We may need to use your details to perform a contracted product or service |

Legal | Regulators, government bodies and courts can order us to provide information and we may have to comply |

6. Who we share personal information with

Our group of companies

As stated, we share personal information among TransUnion companies as appropriate. We’ve set out a list of current such companies below.

Group Company | Physical Address |

TransUnion Africa Holdings (Pty) Ltd | TransUnion |

TransUnion Credit Bureau (Pty) Ltd | |

TransUnion Africa (Pty) Ltd | |

TransUnion Analytic and Decision Services (Pty) Ltd | |

TransUnion Auto Information Solutions (Pty) Ltd |

Service providers

We might provide information to third parties that help us achieve the purposes described in Section 2. For example:

- Cloud-based services, such as Salesforce, to help host, manage and analyse our databases

- Printing companies to produce and send direct mail or other correspondence

- Market research companies to help us better understand our customers

- Third parties that analyse or enhance the data and return the results to us

These service providers can’t use your information for their purposes or on behalf of other organisations unless you agree otherwise.

Regulators

We may sometimes need to pass personal information to a regulator, such as the Information Commissioner’s Office or the Financial Conduct Authority.

7. Where we store and send personal information

We access and use your information from our base in South Africa. We will not transfer personal information to a country lacking laws that provide an adequate level of information protection — unless we have an agreement with the recipient requiring measures that offer a similar level of protection as POPIA in South Africa.

8. Your rights concerning personal information

Access: You have the right to find out if and what personal information we hold about you. Refer to the PAIA Manual on how to request access.

Correction/Destruction/Deletion: If the information we hold about you is inaccurate, irrelevant, excessive, out of date, incomplete, misleading or obtained lawfully, you have a right to ask us to correct it or delete it.

Objection to processing: You may object (on reasonable grounds) to processing your personal information unless legislation provides for such processing.

Objection to direct marketing: You may object to us using your personal information for direct marketing, and if you do, we will stop.

9. Where to lodge a complaint

We strive to deliver the highest levels of customer service. However, if you’re ever unhappy with us, please contact us so we can investigate.

- Post: PO Box 4522, Johannesburg, 2000

- Telephone: 0861 482 482

You can also contact our Information Officer or Deputy Information Officer at TUAPrivacy@transunion.com

You may complain to the Information Regulator:

- Email: complaints.IR@justice.gov.za

- Post: O Box 31533, Braamfontein, Johannesburg, 2017

- Site: https://www.justice.gov.za/inforeg

Version: 2.0

Date adopted: 19 June 2021

This privacy notice provides information about how we use and share personal information relating to consumers who contact us with an enquiry, request or complaint.

In Brief

When you contact us with a request, complaint or enquiry, we will use your personal data in order to help us to respond to you.

Sometimes this will mean sharing personal information with third parties. For example, if you dispute the accuracy of information on your credit report, we may need to contact the organisation who provided us with that information to check whether it is correct.

This notice covers the following topics:

- Who we are and how to contact us

- What we use personal information for

- The kinds of personal information we use and where we get it

- How long we keep personal information

- Our legal basis for handling personal information

- Who we share personal information with

- Where we store and send personal information

- Your rights concerning your personal information

- Where to lodge a complaint

1. Who we are and how to contact us

Information for Good®

We’re in an era of rapid digital transformation where consumers demand more access to seamless, personalised products and services online. But the currency of personal data that fuels this platform economic boom poses threats to individuals and endangers corporate security.

Now more than ever — and likely more so in the future — consumers and corporates need new levels of trust and transparency.

As a global information and insights company, TransUnion seeks to make trust possible. We do this by curating an accurate and comprehensive picture of each consumer so they’re safely and reliably represented in the marketplace. This enables businesses and consumers to transact with confidence and achieve great things. We call this Information for Good.

We’re a group of companies with registered offices at TransUnion, 10th Floor, 11 Alice Lane, Sandton, Johannesburg 2196. Although we’re part of a larger group, this notice covers only the activities of TransUnion companies within the Republic of South Africa.

Joint responsible parties

TransUnion companies sometimes cooperate with other TransUnion companies when sharing and making decisions about your personal information. When this happens, all employees across the group ensure each company involved complies with data protection rules.

Contact our Consumer Services Team to enquire about any of our companies or exercise your rights regarding your personal information.

Contact details

Contact us about personal information issues, including the contents of this notice via:

- Post:TransUnion PO Box 4522 Johannesburg 2000

- Telephone:TransUnion Contact Centre: 0861 482 482

2. What we use personal information for

Enquiries

We use your personal information to deal with any issue or complaint you have raised (which we refer to as an “enquiry”). This might include contacting you for more information or tell you the outcome of your enquiry. Typical enquiries include:

- Requests for access to personal information, to challenge the accuracy of personal data, or to request the erasure of personal information

- Support requests for our consumer products

- Complaints of any nature

- General enquiries

Identity verification

When you contact us, we may need to verify your identity to ensure we don’t provide personal information to unauthorised parties.

Example: identity verification

If someone contacts us and asks us for a copy of your credit report, we’ll check that it’s you (or someone authorised by you) asking for it. We may ask for evidence of identity such as copies of your driving license or a bank statement.

It’s important to do this because the information in your credit report is valuable and could be used to impersonate you if it were to fall into the wrong hands.

Feedback

We may ask you to provide us with feedback or to leave a review about the service you received. Your feedback helps us to improve our services.

Products and services

We use aggregated statistics about enquiries, requests and complaints to help manage our services and identify potential problems. Some enquiries lead to changes to the personal information we use in our products and services.

Constant improvement

We use information from complaints and requests to help understand what went wrong, fix any problems, and improve how we deal with similar issues.

Legal and regulatory purposes

We may use personal information for legal and regulatory purposes. This might include responding to complaints or enquiries from you or a regulator about how we have handled your enquiry or used your personal information.

3. Kinds of personal information we use and where we get it

We obtain and use information from various sources summarised in the following table.

Type of Information | Description | Source |

Basic contact information. | Name, email address and job title | You provide this information when you make an enquiry or when we subsequently request it. |

Your enquiry. | Any enquiry you make | |

Proof of identity or authority and other supporting documentation. | To prove your identity. If you enquire on someone else’s behalf, we may ask for proof of authority, such as a power of attorney. Sometimes we may require additional supporting documentation. | |

Information gathered in dealing with your enquiry. | Dealing with an enquiry involves investigating the circumstances. This type of information depends on the enquiry. | Internal records and external organisations, such as clients and suppliers. |

Our response and other correspondence. | Our response to and other correspondence relating to your enquiry. | We produce this ourselves. |

Website usage. | If you access or submit information through our website, we record information such as IP address, operating system and browser type. | We gather this through the website. |

You are free to choose whether you give us your personal information. However, if you don’t provide the information we need, this may limit our ability to help.

4. How long we keep personal information

We keep your personal information during the enquiry and for an additional period after completion. That period depends on purposes, such as:

- Showing we have processes to deal with enquiries and are doing so fairly under our regulatory requirements

- Responding to you or a regulator to show we dealt with an enquiry properly

- Defending legal claims or regulatory action that might arise because of the enquiry

5. Our legal basis for handling personal information

Legitimate interests

The Protection of Personal Information Act (POPIA) allows personal information usage where necessary for legitimate purposes without undue adverse impact. We base most of our processing activities on the legitimate interests listed below.

Interest | Explanation |

Security | To keep your personal information secure |

Reputation and service improvement | Manage enquiries quickly and efficiently to build our business reputation |

6. Who we share personal information with

Our group of companies

As stated, we share personal information among TransUnion companies as appropriate. We’ve set out a list of current such companies below.

Group Company | Physical Address |

TransUnion Africa Holdings (Pty) Ltd | TransUnion |

TransUnion Credit Bureau (Pty) Ltd | |

TransUnion Africa (Pty) Ltd | |

TransUnion Analytic and Decision Services (Pty) Ltd | |

TransUnion Auto Information Solutions (Pty) Ltd |

Service providers

We may provide information to third parties who help us use it for purposes described in Section 2

Data suppliers and other third parties

If your enquiry is about data supplied to us by third parties, we might provide them with your personal information to help manage your enquiry. For example, if you dispute the accuracy of an entry on your credit file, we may contact the provider of that information to check whether its validity.

These service providers can’t use your information for their purposes or on behalf of other organisations unless you agree otherwise.

7. Where we store and send personal information

We access and use your information from our base in South Africa. However, we will not transfer personal information to a country lacking laws that provide an adequate level of information protection — unless we have an agreement with the recipient requiring measures that offer a similar level of protection as POPIA in South Africa.

8. Your rights concerning your personal information

To enquire about exercising these rights, please contact the TransUnion Contact Centre on 0861 482 482

Access: You have a right to find out if we hold personal information about you and what personal information we hold about you. Please refer to the PAIA Manual on how to request access to the information.

Correction/Destruction/Deletion: If the information that we hold about you is inaccurate, irrelevant, excessive, out of date, incomplete, misleading or obtained unlawfully, you have a right to ask us to correct it or delete it.

Objection to processing your personal information: You may object on reasonable grounds relating to processing your personal information as provided in terms of section 11(3)(a) of PoPIA unless legislation provides for such processing.

Objection to direct marketing: You may object to us using your personal information for direct marketing. If you do, we will stop using it for those purposes.

9. Who can you complain to if you are unhappy about the use of your personal information?

We try to ensure that we deliver the best levels of customer service, but if you are not happy, you should make contact so that we can investigate your concerns. Please contact us using these details.

- Post:PO Box 4522, Johannesburg, 2000

- Telephone:0861 482 482

You can also contact our Information Officer or Deputy Information Officer at TUAPrivacy@transunion.com

You have the right to complain to the Information Regulator:

- Email: complaints.IR@justice.gov.za

- Post: O Box 31533, Braamfontein, Johannesburg, 2017

- Site: https://www.justice.gov.za/inforeg

Version: 2.0

Date adopted: 19 June 2021

This privacy notice provides information about how we use and share the personal information we obtain during the job application process.

This notice covers the following topics:

- Who we are and how to contact us

- What we use personal information for

- The kinds of personal information we use and where we get it

- How long we keep personal information

- Our legal basis for handling personal information

- Who we share personal information with

- Where we store and send personal information

- Your rights concerning your personal information

- Where to lodge a complaint

1. Who we are and how to contact us

Information for Good®

We’re in an era of rapid digital transformation where consumers demand more access to seamless, personalised products and services online. But the currency of personal data that fuels this platform economic boom poses threats to individuals and endangers corporate security.

Now more than ever — and likely more so in the future — consumers and corporates need new levels of trust and transparency.

As a global information and insights company, TransUnion seeks to make trust possible. We do this by curating an accurate and comprehensive picture of each consumer so they’re safely and reliably represented in the marketplace. This enables businesses and consumers to transact with confidence and achieve great things. We call this Information for Good.

We’re a group of companies with registered offices at TransUnion, 10th Floor, 11 Alice Lane, Sandton, Johannesburg 2196. Although we’re part of a larger group, this notice covers only the activities of TransUnion companies within the Republic of South Africa.

Joint responsible parties

TransUnion companies sometimes cooperate with other TransUnion companies when sharing and making decisions about your personal information. When this happens, all employees across the group ensure each company involved complies with data protection rules.

Contact our Consumer Services Team to enquire about any of our companies or exercise your rights regarding your personal information.

Contact details

Contact us about personal information issues, including the contents of this notice via:

- Post:TransUnion PO Box 4522 Johannesburg 2000

- Telephone:TransUnion Contact Centre: 0861 482 482

2. What we use personal information for

Managing end-to-end recruitment

TransUnion Information Group personnel involved in the recruitment process and relevant third parties may communicate with you on a strict need-to-know basis. We do this to show how we conducted the application and recruitment process and arrived at our decision.

Screening checks

TransUnion holds highly confidential data that is subject to stringent legal and regulatory responsibilities. Therefore, we undertake identity verification checks and employment screening to protect the interests of TransUnion, its parent company, clients, partners, and other stakeholders, including consumers and third parties.

Additional information

These checks are mandatory for your application and need to be complete before employment begins. To complete these checks, you may need to present specific documentation, provide additional details, and sign authorisations or acknowledgements. (Further details will be provided with any offer of employment).

We’re mindful of your privacy and will only perform these checks at the appropriate application stage.

3. Kinds of personal information we use and where we get it

We obtain and use information from various sources summarised in the following table.

Type of Information | Description | Source |

Basic contact information. | Name, email address and job title | You provide this information when you make an enquiry or when we subsequently request it. |

Your enquiry. | Any enquiry you make | |

Proof of identity or authority and other supporting documentation. | To prove your identity. If you enquire on someone else’s behalf, we may ask for proof of authority, such as a power of attorney. Sometimes we may require additional supporting documentation. | |

Information gathered in dealing with your enquiry. | Dealing with an enquiry involves investigating the circumstances. This type of information depends on the enquiry. | Internal records and external organisations, such as clients and suppliers. |

Our response and other correspondence. | Our response to and other correspondence relating to your enquiry. | We produce this ourselves. |

Website usage. | If you access or submit information through our website, we record information such as IP address, operating system and browser type. | We gather this through the website. |

You are free to choose whether you give us your personal information. However, if you don’t provide the information we need, this may limit our ability to help.

4. How long we keep personal information

We’ll keep your personal information for as long as we handle your application and for an additional period after completion. That period depends on the following purposes:

- Showing we have processes to deal with enquiries, requests and complaints fairly and under our regulatory requirements

- Responding to you or a regulator about how we dealt with your request and to show we dealt with it appropriately

- Defending any potential legal claims or regulatory action that might arise because of the request

5. Our legal basis for handling personal information

Legitimate interests

The Protection of Personal Information Act (POPIA) allows personal information usage where necessary for legitimate purposes without undue adverse impact. We base most of our processing activities on the following legitimate interests: